accrual basis financials are the two most significant factors in deciding whether you would benefit from the services of a bookkeeper or an accountant. The size of your business and cash basis vs. Would You Benefit From a Bookkeeper or an Accountant? Your long term goals are the priority and focus of the business advisor, and their services can scale to meet the needs of any small business. For established businesses looking to scale, the advisor can help with capital raising, fractional CFO, preparing investor decks and creating business plans. For entrepreneurs just starting out, services like business coaching can develop a roadmap and align your team to be prepared to solve challenges as you grow. The advisor will learn the ins and outs of your business. Some key services offered by a business advisor include: Businesses, both big and small, pre-revenue or looking to scale their already successful model can benefit from advisory services. Whereas the bookkeeping and accounting roles mostly focus on your day-to-day operations and analyzing historical data and trends, the business advisor offers guidance and support for the complexities of a growing business and an uncertain future.

Come tax-time, an accountant’s main goal is to strategically lower your tax liabilities through accelerated depreciation, retirement planning, managing charitable contributions and other write-offs.

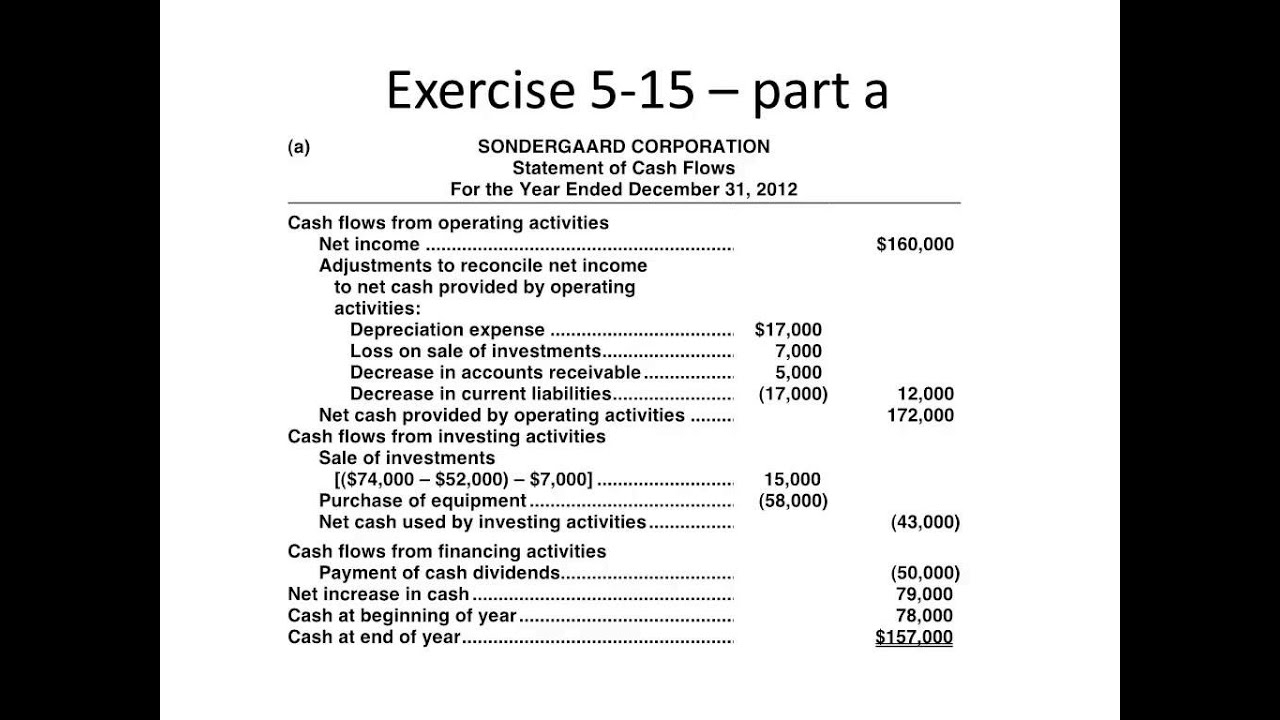

This information can also be presented to investors, creditors, and regulators as the business grows and develops. The creation and review of the financial statements help the business owner understand the effects of their business’s activities and operations. The financial information that the bookkeeper has organized is then supplemented by higher level adjusting entries. Subscribe for updates Online Form - Blog Subscription SignupĪccounting is a more proactive, analytical process.

BOOKKEEPING AND ACCOUNTING FULL

Starting with a powerful, full featured accounting software such as Xero or Quickbooks Online, add-ons like Gusto and ADP can manage payroll, tracks vendors and bill payments, and Shopify tracks customers and orders, just to name a few. These “add-ons” integrate with an accounting software to create a full, modern bookkeeping system. Modern bookkeepers are fortunate to have a wide variety of tools and technology to improve both the efficiency and accuracy of their work.

0 kommentar(er)

0 kommentar(er)